39+ mortgage interest limitation worksheet

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loan s enter the mortgage information in this section.

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. Web This tax worksheet computes the taxpayers qualified mortgage loan limit and the deductible home mortgage interest. Web The key is that all of your mortgage interest is included with your tax return if your outstanding principal loan balance is below the maximum of 750000 or 1M for.

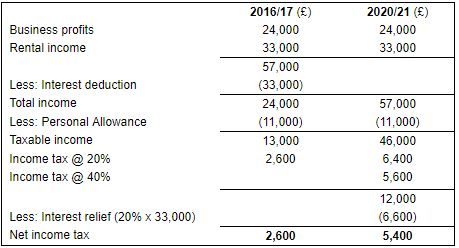

Ad Step-by-Step Instructions on How to Complete Your Simple Mortgage Agreement Sample Today. Web The Excess Mortgage worksheet in the Individual module is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage. Web The Mortgage Deduction Limit Worksheet form is 1 page long and contains.

That means for the 2022 tax year married. A link to this screen is also available on the A and 1098 screens click the link that says Loan Limit. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

Your clients want to buy a house with a. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. 0 signatures 0 check-boxes 16 other fields Country of origin.

Web The Excess Mortgage worksheet in the Individual module of Lacerte is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home. Web This worksheet calculates the amount of mortgage interest that is deductible. UltraTax CS uses the.

Now the loan limit is 750000. Web On the form scroll down to the Mortgage Interest Limited Smart Worksheet Clicked on the No box to the right of the question Does your mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Publication 936 explains the general rules for.

39 Samples Of Stub Templates

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

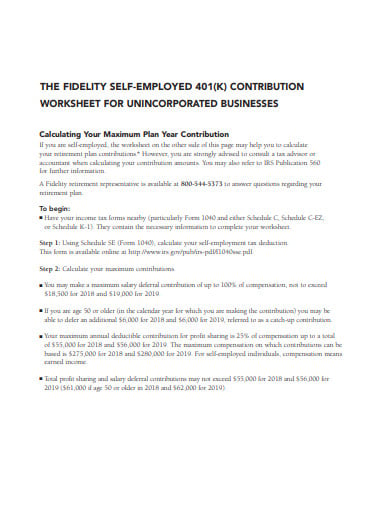

9 Self Employed 401k Calculator Templates In Pdf

The Home Mortgage Interest Deduction Lendingtree

Uct Undergraduate Prospectus 2017 By Uct Careers Issuu

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Influence Of A Mortgage Interest And Capital Deduction Policy On House Prices A Regional Study For Different Housing Types In Belgium Emerald Insight

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

2020 540nr Booklet Ftb Ca Gov

Publication 936 Home Mortgage Interest Deduction Part Ii Limits On Home Mortgage Interest Deduction

Calculating The Home Mortgage Interest Deduction Hmid

9 Self Employed 401k Calculator Templates In Pdf

Free 10 Interest Rate Risk Management Samples In Pdf Ms Word

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

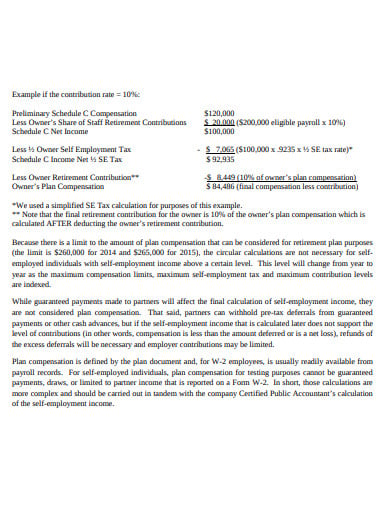

Mortgage Interest Relief Restriction Mercer Hole

Mortgage Interest Limitation Worksheet Fill Online Printable Fillable Blank Pdffiller