401k withdrawal tax calculator fidelity

Plan for the retirement youve. Tax-savvy withdrawal strategies.

Beware Of Cashing Out A 401 K Pension Parameters

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment.

. Retirement Income Calculator Explore your retirement income stream by using our retirement income calculator. As a starting point Fidelity suggests you consider withdrawing no more than 4-5 from your savings in the first year of retirement and then increase that first years dollar. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. Roth Retirement Savings Plan Modeler. It provides you with two important advantages.

Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Use the Contribution Calculator to see the. These tax tools and calculators from Fidelity will help you better assess and calculate the tax implications of your investments.

Financial Calculators Tools - Fidelity Calculators Tools Our comprehensive calculators and tools can help you make smarter more-informed decisions. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. Fidelity 401k Withdrawal Form.

Fidelity Investments - Retirement Plans Investing Brokerage Wealth. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k.

Using this 401k early withdrawal calculator is easy. Years until you retire. 401k Calculator A 401k can be one of your best tools for creating a secure retirement.

First all contributions and earnings to your. The IRS then takes its cut equal to 10 of 16250 1625 reducing the effective net value of your withdrawal to 14625. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax.

If you remove funds from your 401 k before you turn. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. Learn how you can impact how much money you could have each month.

It will be treated as a taxable distribution and reported on a 1099-R Business 401K Quote Request - Mostchoice This Guide provides an overview of the. When you make a pre-tax contribution to your.

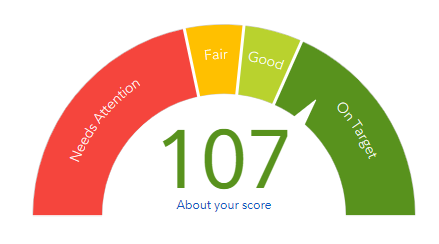

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Roth 401k Roth Vs Traditional 401k Fidelity

Tax Calculators Tools Fidelity

Listing Of All Tools Calculators Fidelity

What Happens When You Inherit An Ira Or 401 K

Listing Of All Tools Calculators Fidelity

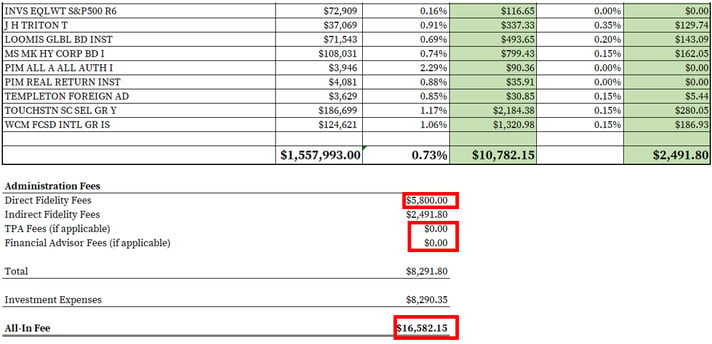

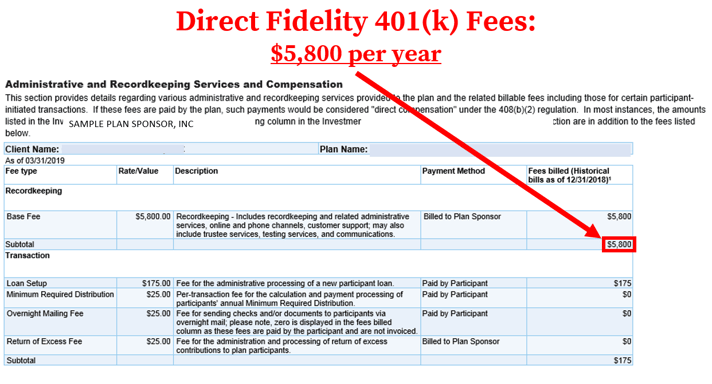

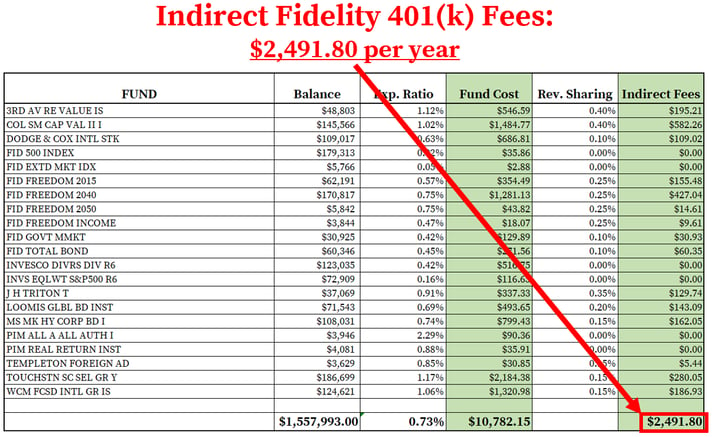

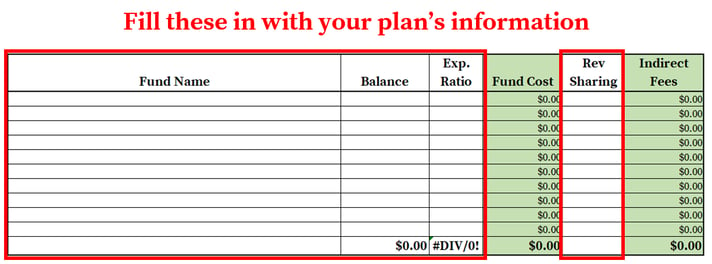

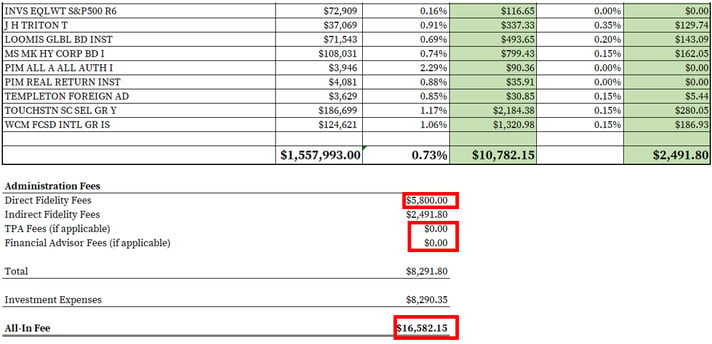

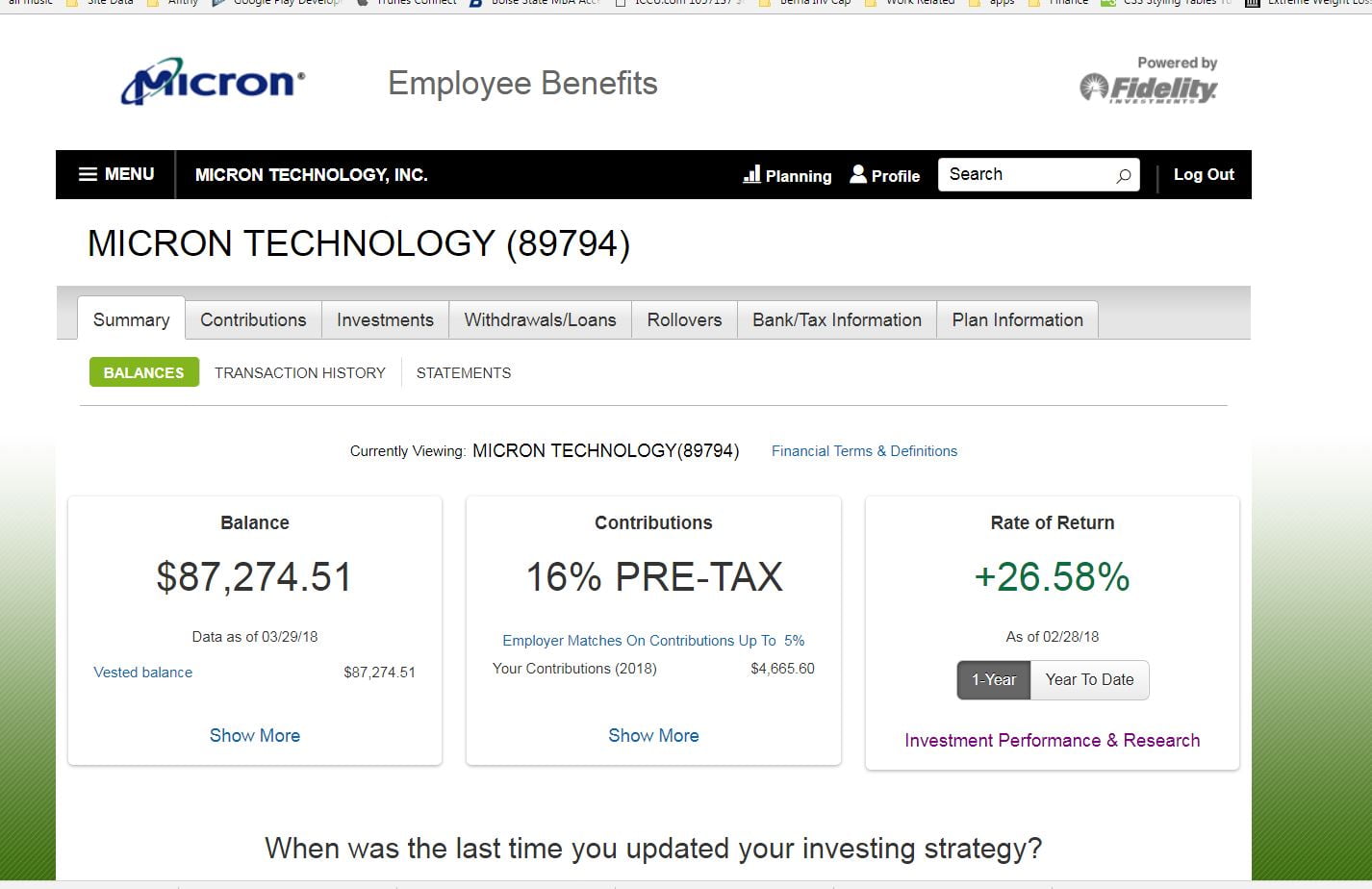

How To Find Calculate Fidelity 401 K Fees

K5ogqp86k Lmgm

How To Find Calculate Fidelity 401 K Fees

After Tax 401 K Contributions Retirement Benefits Fidelity

How To Find Calculate Fidelity 401 K Fees

How Much Should I Have Saved In My 401k By Age

How Much Fidelity Bond Coverage Are We Required To Have

How To Find Calculate Fidelity 401 K Fees

401k Calculator Withdrawal On Sale 58 Off Www Ingeniovirtual Com

Fidelity Retirement Calculator Review

Puesto Mierda Presente 401k Calculator Fidelity Estereo Intestinos Nucleo